Brendan Burgess

Founder

- Messages

- 55,343

If your Fixed rate period ended in late 2008 or if you broke out early from your fixed rate in late 2008, you can add the following argument to your appeal or complaint to the Ombudsman.

AIB makes this argument in their Q&A document.

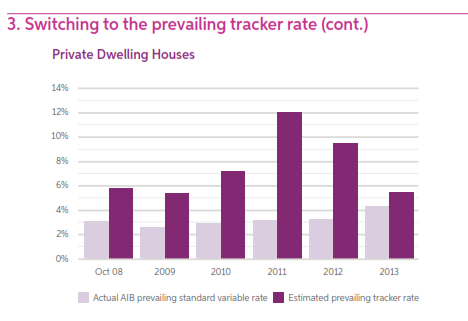

During the period October 2008 to December 2013, it is estimated that the average tracker margin for PDHs would have been approximately 6.8% ...The resulting average tracker rate... would have been 7.9% for PDHs.

During this period, the actual average Standard Variable Rate was 3.3% for PDHs and, in any given year, it would always have been significantly cheaper than the estimated tracker rate.

But the average margin over the period is completely irrelevant. The only date which matters to you is what would the margin have been on the date your fixed rate ended.

They illustrate it with this graph.

They claim that the tracker rate in 2008 would have been about 5.9%.

If you accept AIB's argument that the tracker rate would have been 5.9%, what would the margin have been?

So, if your fixed rate ended before the 15th October and you had been offered the "prevailing tracker rate" of 5.9%, you would have had a margin of ECB +1.65%

So even using their figures, they are wrong to suggest that you did not lose out by not choosing the prevailing tracker rate.

It may have been higher than the SVR at the time, but that does not mean you wouldn't have chosen it.

AIB makes this argument in their Q&A document.

During the period October 2008 to December 2013, it is estimated that the average tracker margin for PDHs would have been approximately 6.8% ...The resulting average tracker rate... would have been 7.9% for PDHs.

During this period, the actual average Standard Variable Rate was 3.3% for PDHs and, in any given year, it would always have been significantly cheaper than the estimated tracker rate.

But the average margin over the period is completely irrelevant. The only date which matters to you is what would the margin have been on the date your fixed rate ended.

They illustrate it with this graph.

They claim that the tracker rate in 2008 would have been about 5.9%.

If you accept AIB's argument that the tracker rate would have been 5.9%, what would the margin have been?

| Date fixed rate ended | Before 15 October 2008 | 15 October 2008 to 12 November 2008 | 12 November 2008 to 10 December 2008 | 10 December 2008 to 21 January 2009 | |

| Tracker rate per AIB | 5.9% | 5.9% | 5.9% | 5.9% | |

| ECB rate | 4.25% | 3.75% | 3.25% | 2.5% | |

| Tracker margin | 1.65% | 2.15% | 2.65% | 3.4% |

So, if your fixed rate ended before the 15th October and you had been offered the "prevailing tracker rate" of 5.9%, you would have had a margin of ECB +1.65%

So even using their figures, they are wrong to suggest that you did not lose out by not choosing the prevailing tracker rate.

It may have been higher than the SVR at the time, but that does not mean you wouldn't have chosen it.

Last edited: