Hi,

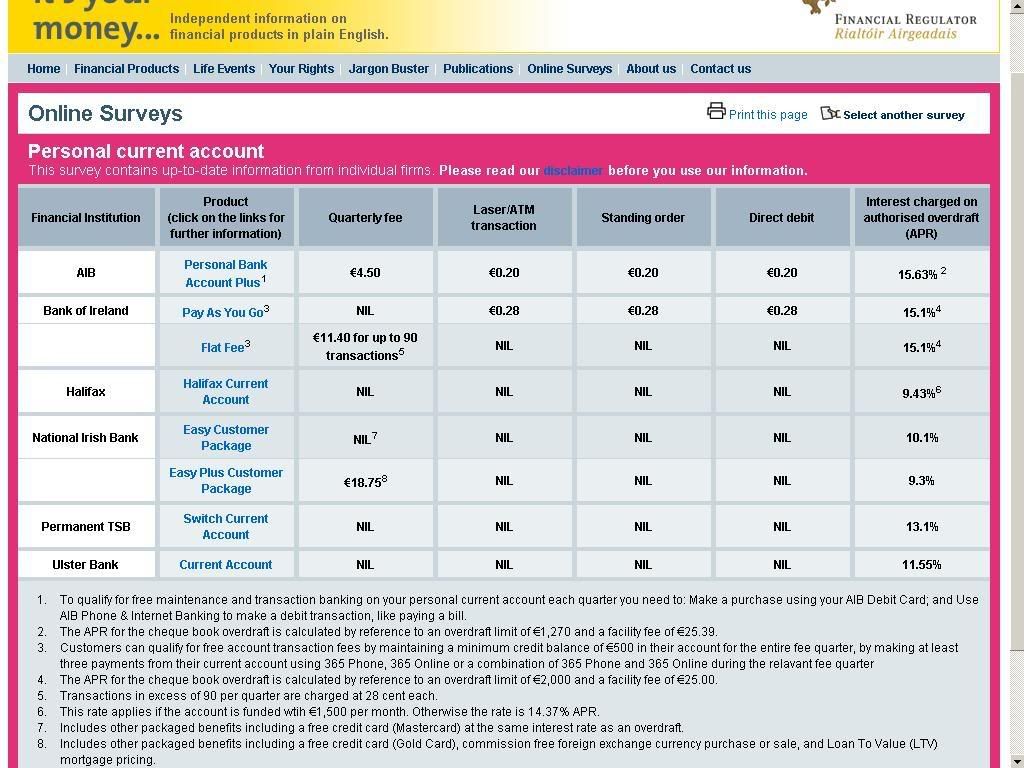

I've noticed that BOI are offering current account interest on balances up to 1500 euro. I've read a little already on Best Buys about this and checked out their website.

I have free day to day banking at present and it would be nice to earn some interest on it. I plan on calling into my local branch to discuss further.

Apart from maintaining at least 500 euro minimum balance at all times and carrying out 3 payments per quarter, are there any other catches to this? Is it exactly as it says on the tin?

I've noticed that BOI are offering current account interest on balances up to 1500 euro. I've read a little already on Best Buys about this and checked out their website.

I have free day to day banking at present and it would be nice to earn some interest on it. I plan on calling into my local branch to discuss further.

Apart from maintaining at least 500 euro minimum balance at all times and carrying out 3 payments per quarter, are there any other catches to this? Is it exactly as it says on the tin?