Hi All,

I am a 29 year old primary school teacher who has an AVC with Cornmarket (Irish life) for 2023 and 2024. I am looking to switch to a Zurich execution only AVC and pay 8.5% of my salary (work contributes 6.5%), maxing out my contribution of 15%. I will be 30 next year so will be able to contribute 13.5% (and work will contribute 6.5%) from January.

Q. I am wondering if I can transfer over my AVC from Cornmarket (Irish Life) to Zurich? Or is leaving the amount there untouched more beneficial.

Q. I am also wondering if I can schedule my Irish Life (Cornmarket) AVC to stop at the 31st of December and start my Zurich from the 1st of January?

Q. With the execution only service, can i adjust my AVC as my salary increases annually?

Q. When i have my execution only fund set up, when do you recommend revisiting it? 5-10 years before retirement I have heard?

Q. How do I claim tax relief each year, its through Revenue I have heard, but I am wondering which form is needed?

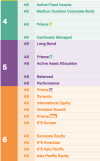

Q. My final question (the most important question) is which Zurich fund would you recommend? I have a picture attached. I would like to take a higher risk approach.

Any help with any of these questions would be greatly appreciated.

Thank you very much.

I am a 29 year old primary school teacher who has an AVC with Cornmarket (Irish life) for 2023 and 2024. I am looking to switch to a Zurich execution only AVC and pay 8.5% of my salary (work contributes 6.5%), maxing out my contribution of 15%. I will be 30 next year so will be able to contribute 13.5% (and work will contribute 6.5%) from January.

Q. I am wondering if I can transfer over my AVC from Cornmarket (Irish Life) to Zurich? Or is leaving the amount there untouched more beneficial.

Q. I am also wondering if I can schedule my Irish Life (Cornmarket) AVC to stop at the 31st of December and start my Zurich from the 1st of January?

Q. With the execution only service, can i adjust my AVC as my salary increases annually?

Q. When i have my execution only fund set up, when do you recommend revisiting it? 5-10 years before retirement I have heard?

Q. How do I claim tax relief each year, its through Revenue I have heard, but I am wondering which form is needed?

Q. My final question (the most important question) is which Zurich fund would you recommend? I have a picture attached. I would like to take a higher risk approach.

Any help with any of these questions would be greatly appreciated.

Thank you very much.