Brendan Burgess

Founder

- Messages

- 55,287

The Central Bank has published its mortgage rates data today, and for the first time, provides the information for new business excluding trackers.

[broken link removed]

Of course, the Central Bank, for its own reasons, hides the vastly higher rate in a long complicated series of figures and graphs and verbiage.

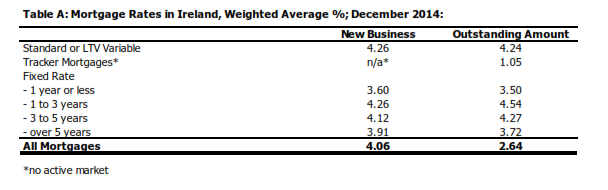

The rate in Ireland is 4.26% from the Table at the end of the Information Sheet

The comparable rate for the Eurozone is 2.47%

From Page 2 of Statistical Release

Why does the Central Bank not highlight the fact that Irish borrowers are paying 1.79% more than borrowers in other Eurozone countries?

It’s hard to know. It could be that they want Irish variable rate borrowers to continue paying over the odds to maximise the profitability and solvency of the Irish banks and to subsidise the trackers and the defaulting mortgages.

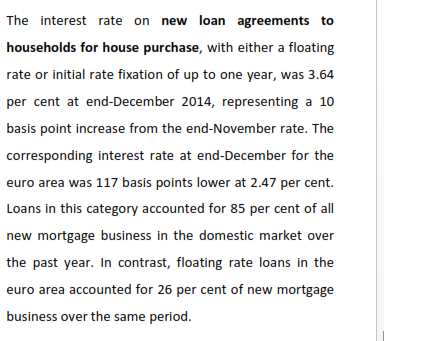

What is the “3.64%” rate mentioned above?

It’s a nonsense figure which classifies rescheduled tracker mortgages as new business. You can see how nonsensical it is by the fact that it has increased by 10 basis points since November. The true interest rates have been falling in the last couple of months.

Why does the Central Bank persist in publishing such nonsense?

I have no idea. They claim it’s done on a standardised basis across the ECB.

But they should not highlight this figure as they know it includes rescheduled trackers which have an average rate of 1.05%

They definitely should not be making a false comparison claiming that the rate in the Eurozone is 117 basis points lower when it’s actually 177 basis points lower.

How much is this higher rate costing the average Irish variable rate mortgage holder?

If the average mortgage is €200,000, then the additional interest paid is €3,580 per year or €300 per month.

[broken link removed]

Of course, the Central Bank, for its own reasons, hides the vastly higher rate in a long complicated series of figures and graphs and verbiage.

The rate in Ireland is 4.26% from the Table at the end of the Information Sheet

The comparable rate for the Eurozone is 2.47%

From Page 2 of Statistical Release

Why does the Central Bank not highlight the fact that Irish borrowers are paying 1.79% more than borrowers in other Eurozone countries?

It’s hard to know. It could be that they want Irish variable rate borrowers to continue paying over the odds to maximise the profitability and solvency of the Irish banks and to subsidise the trackers and the defaulting mortgages.

What is the “3.64%” rate mentioned above?

It’s a nonsense figure which classifies rescheduled tracker mortgages as new business. You can see how nonsensical it is by the fact that it has increased by 10 basis points since November. The true interest rates have been falling in the last couple of months.

Why does the Central Bank persist in publishing such nonsense?

I have no idea. They claim it’s done on a standardised basis across the ECB.

But they should not highlight this figure as they know it includes rescheduled trackers which have an average rate of 1.05%

They definitely should not be making a false comparison claiming that the rate in the Eurozone is 117 basis points lower when it’s actually 177 basis points lower.

How much is this higher rate costing the average Irish variable rate mortgage holder?

If the average mortgage is €200,000, then the additional interest paid is €3,580 per year or €300 per month.