petergriffin83

New Member

- Messages

- 3

Personal details

Age: 40

Spouse's age: 38

Number and age of children: Three children, 7/3/1 years old.

Income and expenditure

Annual gross income from employment or profession: 100k (85k salary, approx 15k bonus)

Annual gross income of spouse/partner: 35k

Monthly take-home pay: 5k

Type of employment - Both PAYE Employees

Employer type: Both in private companies.

In general are you:

(a) spending more than you earn, or

(b) saving? Saving

Summary of Assets and Liabilities

Family home value: 750k

Mortgage on family home: 262k

Net equity: 488k

Cash: 30k (all in bank accounts at 3% interest)

Defined Contribution pension fund: 15k

Company shares : 40k

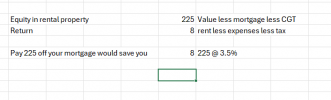

Buy to Let Property value: 270k

Buy to let Mortgage: 40k

Total net assets: 718k

Family home mortgage information

Lender AIB

Interest rate 2.1%

Type of interest rate: Fixed with 1 year remaining

Remaining term: 19 years

Monthly repayment: €1,153

Other borrowings – car loans/personal loans etc

None

Do you pay off your full credit card balance each month? Yes - always.

Pension information

Value of pension fund: 170k + 30k (spouse)

Buy to let properties

Value: 270k

Rental income per year: €20,340

Rough annual expenses other than mortgage interest : 3k

Lender UB

Interest rate 4.5%

If fixed, what is the term remaining of the fixed rate? 2 years

Other savings and investments: 30k cash and 40k in company shares (vesting over next 3 years)

Other information which might be relevant

Life insurance: Cover in place provided by employer.

What specific question do you have or what issues are

of concern to you?

Hi folks, first time poster but long time reader of treads on this site. I've got some good advice from here over the years.

The question I have is regarding our BTL property. Should we sell or keep?

Tenants have recently gave notice to leave so we have always said we would evaluate keep/sell options at any point tenants leave. I am leaning towards selling and my wife is leaning towards keep, but either of us could be convinced to change our minds. My plan if we were to sell would be to use the after tax profits to pay down our home mortgage and then focus on paying the remaining balance over the next 2 years. The question is what to do then? I think we should focus on increasing pension contributions. I currently contribute 25% of salary but spouse I feel needs to contribute more to avail of the tax free lump sum. The ultimate goal would be to maximise our wealth so we hopefully have an option of early retirement at around 60 years old.

I'd appreciate any advice or thoughts on our situation.

Age: 40

Spouse's age: 38

Number and age of children: Three children, 7/3/1 years old.

Income and expenditure

Annual gross income from employment or profession: 100k (85k salary, approx 15k bonus)

Annual gross income of spouse/partner: 35k

Monthly take-home pay: 5k

Type of employment - Both PAYE Employees

Employer type: Both in private companies.

In general are you:

(a) spending more than you earn, or

(b) saving? Saving

Summary of Assets and Liabilities

Family home value: 750k

Mortgage on family home: 262k

Net equity: 488k

Cash: 30k (all in bank accounts at 3% interest)

Defined Contribution pension fund: 15k

Company shares : 40k

Buy to Let Property value: 270k

Buy to let Mortgage: 40k

Total net assets: 718k

Family home mortgage information

Lender AIB

Interest rate 2.1%

Type of interest rate: Fixed with 1 year remaining

Remaining term: 19 years

Monthly repayment: €1,153

Other borrowings – car loans/personal loans etc

None

Do you pay off your full credit card balance each month? Yes - always.

Pension information

Value of pension fund: 170k + 30k (spouse)

Buy to let properties

Value: 270k

Rental income per year: €20,340

Rough annual expenses other than mortgage interest : 3k

Lender UB

Interest rate 4.5%

If fixed, what is the term remaining of the fixed rate? 2 years

Other savings and investments: 30k cash and 40k in company shares (vesting over next 3 years)

Other information which might be relevant

Life insurance: Cover in place provided by employer.

What specific question do you have or what issues are

of concern to you?

Hi folks, first time poster but long time reader of treads on this site. I've got some good advice from here over the years.

The question I have is regarding our BTL property. Should we sell or keep?

Tenants have recently gave notice to leave so we have always said we would evaluate keep/sell options at any point tenants leave. I am leaning towards selling and my wife is leaning towards keep, but either of us could be convinced to change our minds. My plan if we were to sell would be to use the after tax profits to pay down our home mortgage and then focus on paying the remaining balance over the next 2 years. The question is what to do then? I think we should focus on increasing pension contributions. I currently contribute 25% of salary but spouse I feel needs to contribute more to avail of the tax free lump sum. The ultimate goal would be to maximise our wealth so we hopefully have an option of early retirement at around 60 years old.

I'd appreciate any advice or thoughts on our situation.