Brendan Burgess

Founder

- Messages

- 55,395

As this is being discussed in many different threads, I am going to try to pull them altogether in one thread. Feel free to ask additional questions or correct some part of it. But don't just chat or let off steam in this thread. If you do, your post will be removed.

Why have I been put on such a high rate?

Many permanent tsb mortgage offers contained a specific tracker rate e.g. "On expiry of the fixed term, you will be put on a rate of ECB + 0.8%". However, your contract did not have this specific price promise. It said something like:

On expiry of the fixed rate period, and where the applicant chooses the option of a tracker mortgage interest rate, the interest rate applicable to the loan will be the tracker mortgage rate appropriate to the balance outstanding on the loan at the date of expiry of the fixed rate period.

How was this particular rate decided?

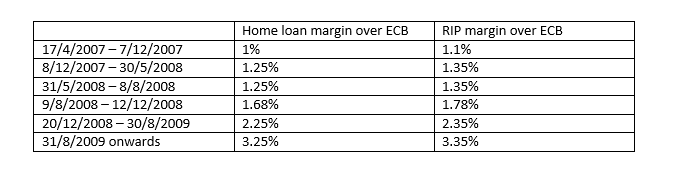

ptsb were free to set the margin as they saw fit. User Highchair has provided the following very useful information in this post.

But I broke out of the fixed rate in early February 2009, and they have put me on the 3.25% rate?

According to permanent tsb, it is not the date you broke out of the fixed rate, but the date your fixed rate was due to expire.

But before I fixed, I was on a rate of ECB + 0.8%, so I expected to be put on that after the fixed rate ended?

Unfortunately, that is not what your contract says.

I thought that the margin on a tracker mortgage couldn't change?

permanent tsb's contract only specified that you would get a tracker. They did not specify the margin until after the fixed term expired.

I am going to appeal this rate, should I hold off sending back the forms which came with the redress notification?

No. You should send back the forms immediately. You can appeal any aspect of the offer, including the rate later.

You can accept the compensation on offer from ptsb and still appeal

If I am on a rate of ECB +3.25%, maybe I should switch to another lender with a cheaper rate?

At the moment, the cheapest rate is 3.35% with AIB for an LTV of <50%. Bank of Ireland will give you a fixed rate for one year of 3.6% and 2% of the amount borrowed back. But you will roll on to their SVR of 4.5% when the one year is up.

The 3.25% is a high margin, but the fixed nature of the margin is valuable and you should think long and hard before switching to another lender who could increase rates at will.

I have seen that some people challenged this rate, and had it reduced?

Rate reduced from 3.3% to 1.73% on appeal

I suspect that the contract actually specified a rate.

How many people are affected by this?

123 customers have been put on a rate of 2.3% or 2.4%

358 customers have been put on a rate of 3.3% or 3.4%

Why have I been put on such a high rate?

Many permanent tsb mortgage offers contained a specific tracker rate e.g. "On expiry of the fixed term, you will be put on a rate of ECB + 0.8%". However, your contract did not have this specific price promise. It said something like:

On expiry of the fixed rate period, and where the applicant chooses the option of a tracker mortgage interest rate, the interest rate applicable to the loan will be the tracker mortgage rate appropriate to the balance outstanding on the loan at the date of expiry of the fixed rate period.

How was this particular rate decided?

ptsb were free to set the margin as they saw fit. User Highchair has provided the following very useful information in this post.

But I broke out of the fixed rate in early February 2009, and they have put me on the 3.25% rate?

According to permanent tsb, it is not the date you broke out of the fixed rate, but the date your fixed rate was due to expire.

But before I fixed, I was on a rate of ECB + 0.8%, so I expected to be put on that after the fixed rate ended?

Unfortunately, that is not what your contract says.

I thought that the margin on a tracker mortgage couldn't change?

permanent tsb's contract only specified that you would get a tracker. They did not specify the margin until after the fixed term expired.

I am going to appeal this rate, should I hold off sending back the forms which came with the redress notification?

No. You should send back the forms immediately. You can appeal any aspect of the offer, including the rate later.

You can accept the compensation on offer from ptsb and still appeal

If I am on a rate of ECB +3.25%, maybe I should switch to another lender with a cheaper rate?

At the moment, the cheapest rate is 3.35% with AIB for an LTV of <50%. Bank of Ireland will give you a fixed rate for one year of 3.6% and 2% of the amount borrowed back. But you will roll on to their SVR of 4.5% when the one year is up.

The 3.25% is a high margin, but the fixed nature of the margin is valuable and you should think long and hard before switching to another lender who could increase rates at will.

I have seen that some people challenged this rate, and had it reduced?

Rate reduced from 3.3% to 1.73% on appeal

I suspect that the contract actually specified a rate.

How many people are affected by this?

123 customers have been put on a rate of 2.3% or 2.4%

358 customers have been put on a rate of 3.3% or 3.4%

Last edited: