Hi Sop

I thought that this deserved a thread of its own.

I have amended the post in the main thread to say :

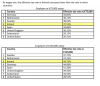

The Tax Institute did a comparison. It shows very clearly for single employees, using the theoretical tax rates:

- The lower paid in Ireland pay very little tax compared other countries

- The middle paid e.g. someone earning €35,783 pays lowish levels of taxes

- Someone earning around €75,000 pays about the average - not too high or too low

- The higher paid pay higher rates compared to other countries

Which of these conclusions are not valid?

The lower paid pay only 4.88% tax in Ireland. Your caveat could make it only lower, but not much lower, I suspect. Therefore that conclusion holds.

"The higher paid pay higher rates compared to other countries"

"the Taxation Institute figures are purely notional based on the grant of just the Single Personal and PAYE credits - in other words, it is ignoring any other tax reliefs claimed, thus exaggerating the effective rate."

But presumably they do this for the other countries as well? Are Irish tax reliefs for medical expenses and pensions much higher than in other countries?

But let's err on the conservative side. If we take the TASC figures as more reliable, say it's 40%. So the conclusion would be that "single employed individuals pay around the same levels of taxes on incomes as in other comparable countries"?

The Irish tax system strongly rewards marriage and children (through child benefit). So I suspect that tax rates for married people with children are probably lower in Ireland. We have negative tax rates on the lower paid and probably lower than average on the higher paid?