Brendan Burgess

Founder

- Messages

- 52,050

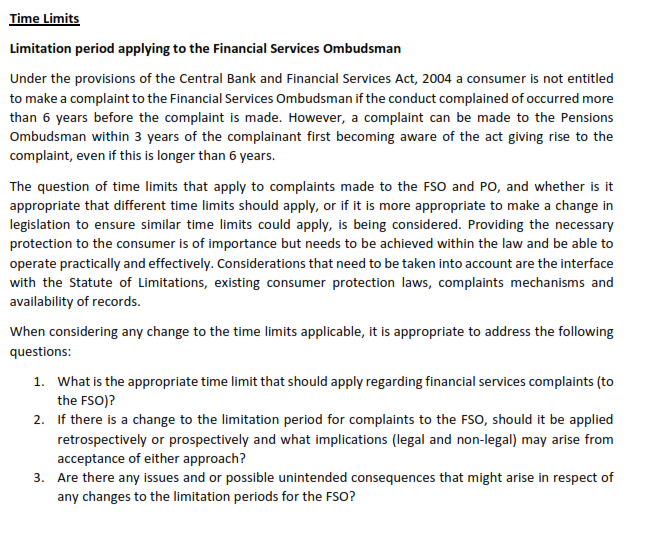

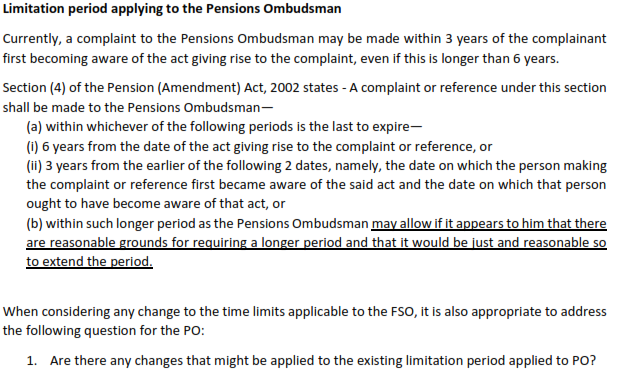

The Department of Finance has a consultation on the legislation covering the Financial Services Ombudsman which closes on Wed 5 March. Here is the section dealing with the 6 year time rule.

The benefits to this are enormous to customers. And you can be very sure that banks will suddenly be very very careful not to mis sell any product. Up to now they could rely on the 6 year rule to get them over the line, meaning most people were beyond the 6 years when they realised there was something wrong with a product/loan/insurance etc.

There would also be benefits to the FSO office as there would be less cases.

On the 6 year rule.

Couple of years back, Law Reform Commission recommended to the effect that complaints should be allowed for 2 years from the time they were noticed (largely as happens in Pensions).

I do not keep a file on what law reform commission proposed , but I am assured that that recommendation from the Commission and allied documentation has been forwarded.Hi Gerry

This sort of factual based comment would make a great submission on the consultation.

You can be quite sure that your {friends}, the banks, will be making submissions to the contrary.

Brendan