We're currently searching for houses and have mortgage approval in principle from BOI. Likely total cost will be 700K range: purchase of 550K and 150K renovation and extension cost. After deposit of 110K, total mortgage amount will be 590K.

Current mortgage has 275K remaining (house is valued at roughly 340K) and the mortgage is with BOI and is a tracker of ECB + 0.70% (followed advice on here 10 years ago and negotiated a good rate). Preference would be to keep our current house at least until completion of the renovation and extension work to minimise hassle (2nd baby on the way). Have approval from BOI for this arrangement.

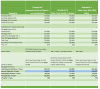

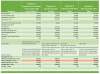

But now rethinking it, taking the tracker with us would likely be the most economical approach, for the first 5 years at least. BOI have indicated we could take the 275K tracker to the new house at 1% higher, so ECB +1.7%, with their standard 3.6% on the remaining 315K, and revert to standard variable for the full amount after 5 years.

I would like to calculate the monthly repayment and total cost of funding for both of these options and then make a final decision (e.g. if saving was minimal, we might keep the current house and sell it later if we felt capital may increase and offset the worse rate, but if it was a major difference, we would sell now and move the tracker). I'm aware of online mortgage cost calculators but they seem to be for more straightforward scenarios, what's the best tool or formula for calculating the monthly and total costs of this more complex scenario?

Current mortgage has 275K remaining (house is valued at roughly 340K) and the mortgage is with BOI and is a tracker of ECB + 0.70% (followed advice on here 10 years ago and negotiated a good rate). Preference would be to keep our current house at least until completion of the renovation and extension work to minimise hassle (2nd baby on the way). Have approval from BOI for this arrangement.

But now rethinking it, taking the tracker with us would likely be the most economical approach, for the first 5 years at least. BOI have indicated we could take the 275K tracker to the new house at 1% higher, so ECB +1.7%, with their standard 3.6% on the remaining 315K, and revert to standard variable for the full amount after 5 years.

I would like to calculate the monthly repayment and total cost of funding for both of these options and then make a final decision (e.g. if saving was minimal, we might keep the current house and sell it later if we felt capital may increase and offset the worse rate, but if it was a major difference, we would sell now and move the tracker). I'm aware of online mortgage cost calculators but they seem to be for more straightforward scenarios, what's the best tool or formula for calculating the monthly and total costs of this more complex scenario?