Brendan Burgess

Founder

- Messages

- 52,045

Hi Warren

This is a very interesting case study of the dangers of borrowing from a Credit Union.

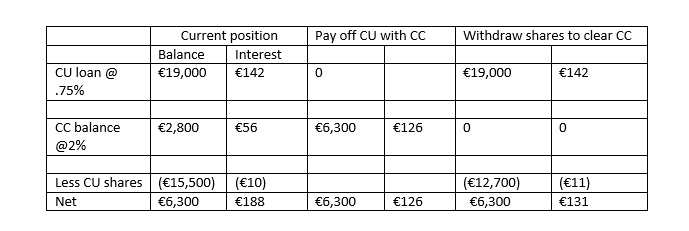

You don't tell us the interest rate on the Credit Union loan. I have assumed it is 9% a year or 0.75% a month. If so, then here is how I see it:

At present you are paying €188 per month on net borrowing of €6,300, which is an effective rate of 36%.

It seems that withdrawing cash from the Credit Card is the best bet. It's bizarre, but I think it's correct. Especially if you can get zero interest on the Credit Card.

Brendan

This is a very interesting case study of the dangers of borrowing from a Credit Union.

You don't tell us the interest rate on the Credit Union loan. I have assumed it is 9% a year or 0.75% a month. If so, then here is how I see it:

At present you are paying €188 per month on net borrowing of €6,300, which is an effective rate of 36%.

It seems that withdrawing cash from the Credit Card is the best bet. It's bizarre, but I think it's correct. Especially if you can get zero interest on the Credit Card.

Brendan