Brendan Burgess

Founder

- Messages

- 55,344

I am trying to understand what happened here and it's like piecing together a jigsaw. But I still have a few missing pieces.

Genesis is a Crypto Broker ( like Coinbase or FTX ?)

They had three subsidiaries

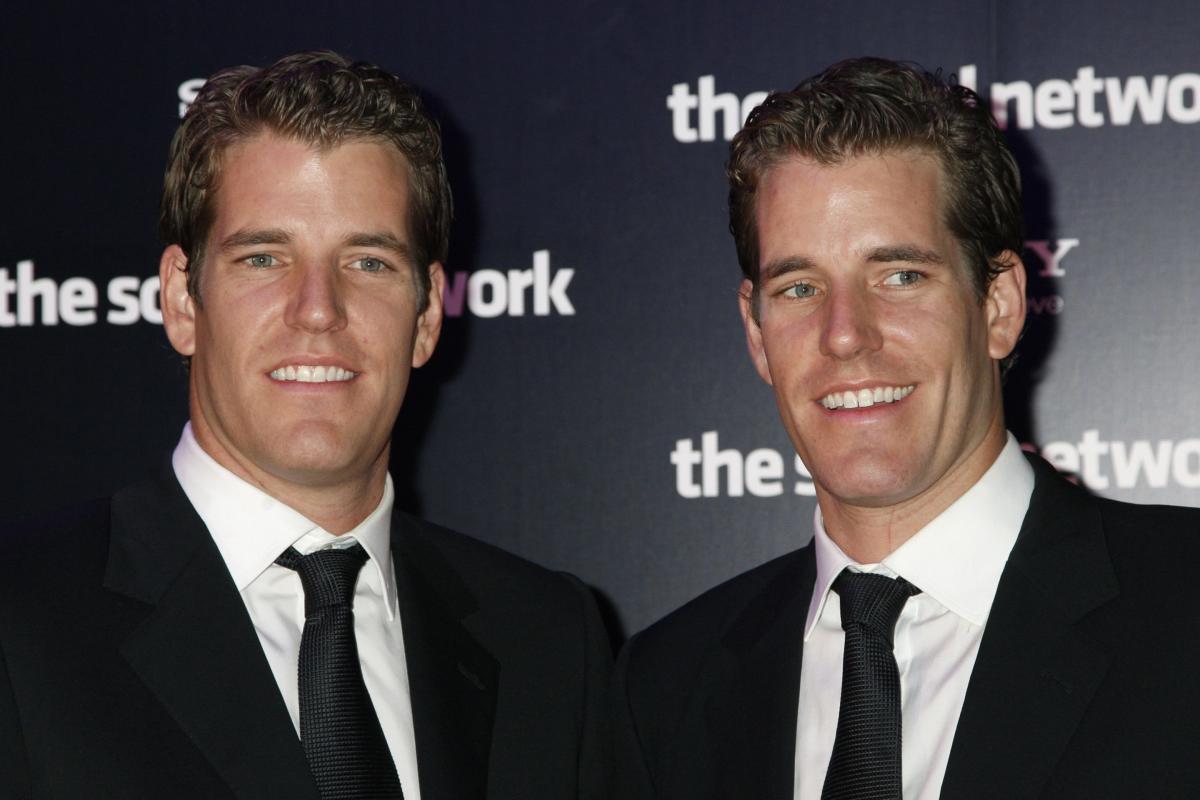

Gemini is a crypto exchange owned by the Winklevoss brothers

Gemini is regulated by the SEC

They had a product called "Earn" (Some dispute over whether this is a regulated product)

340,000 of Gemini's customers put in $900m of real money into Earn in the expectation that they would get a return of 7% a year.

Gemini lent(?) that money to Genesis's lending unit.

Now these customers can't get their money back.

1) Is a crypto broker the same as a crypto exchange?

2) Who did Genesis lend to other than FTX?

3) Why would they lend crypto? Is it so that the borrower can speculate?

4) Aren't the Winklevoss brothers multi-billionaires? Why don't they just bail out their customers who have lost money?

I have little sympathy for people who expect to get a return of 7% without taking huge risk, but against that, many ordinary people are blinded into making stupid decisions in the crypto space.

Genesis is a Crypto Broker ( like Coinbase or FTX ?)

They had three subsidiaries

- Trading - not affected

- Custody - not affected

- lending unit - gone into Chapter 11

Gemini is a crypto exchange owned by the Winklevoss brothers

Gemini is regulated by the SEC

They had a product called "Earn" (Some dispute over whether this is a regulated product)

340,000 of Gemini's customers put in $900m of real money into Earn in the expectation that they would get a return of 7% a year.

Gemini lent(?) that money to Genesis's lending unit.

Now these customers can't get their money back.

1) Is a crypto broker the same as a crypto exchange?

2) Who did Genesis lend to other than FTX?

3) Why would they lend crypto? Is it so that the borrower can speculate?

4) Aren't the Winklevoss brothers multi-billionaires? Why don't they just bail out their customers who have lost money?

I have little sympathy for people who expect to get a return of 7% without taking huge risk, but against that, many ordinary people are blinded into making stupid decisions in the crypto space.