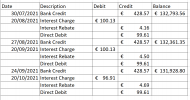

Hi, I have an old BOSI Interest only Tracker, now managed by Pepper. Over the last few years I have made a series of one-off payments to eat into the capital amount. For a long time, each time I did that, the main capital balance would reduce and the following month’s Interest payments were also reduced a little, to allow for the reduced capital amount. However, at some point in the last 2-3 years I have noticed that the one-off payments are no longer directly removed from the outstanding capital balance, but are shown as “arrears”. The ongoing interest only payments are not reducing as before, but instead I think the surplus interest amounts are also being knocked off the capital balance. Is my understanding correct? I don’t remember them writing to me advising of the change?

Anyone familiar with this care to comment please?

Anyone familiar with this care to comment please?