Brendan Burgess

Founder

- Messages

- 55,239

In 99% of cases, you should not overpay a cheap tracker!

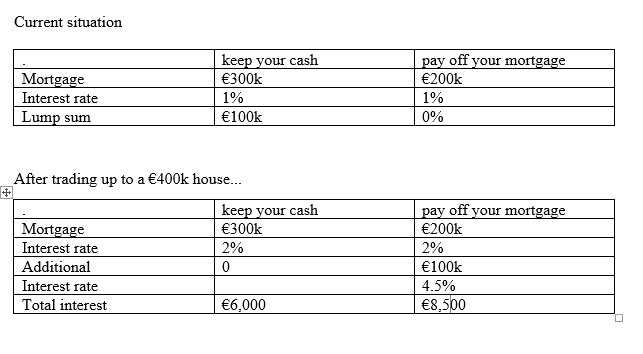

1)If you are thinking of trading up, or even if you might trade up, you should not pay off your mortgage

All of the main banks allow you to transfer your tracker if you want to trade up, usually at an extra 1%.

In addition, it is much easier to trade up if you have €100k cash, especially if you are in negative equity

2) The lenders might do a deal at some stage to encourage early repayment of your mortgage

While all the banks deny that they will do this, their policy may change in the future.

In particular, Danske Bank and Bank of Scotland want out of the market as quickly as possible. They may sell on your mortgage to a vulture fund, who may give you such a discount. Ulster Bank and ptsb may sell off their cheap trackers.

While the correct financial decision is not to overpay your mortgage, it is better to overpay it than to squander it

If you are good with money, it's better to have a €300k tracker mortgage and €100k in a deposit account, than to have a €200k mortgage.

However, if the presence of €100k tempts you to squander the money, then you should pay down the mortgage.

Other reasons you might pay a lump-sum off your tracker

1) You are concerned that the deposit in the bank might not be safe.

2) Ireland might pull out of the euro. There is a risk that if Ireland pulls out of the euro, your deposit might be converted to punts while your mortgage stays in euro.

3) Having a lump sum might reduce your means tested social welfare payments

If you decide not to pay off your tracker, are there alternatives to deposits worth considering?

Whatever alternative you consider, you must have quick access to your money, in case a deal becomes available.

Investing directly in a balanced portfolio of shares is worth considering. However, you have to realise that there is a risk that the value may fall.

You could consider a unit linked fund or ETF, as long as there are no initial charges or exit charges.

It would generally not be a good idea to invest in property as you will not be able to access your cash if you need it.

1)If you are thinking of trading up, or even if you might trade up, you should not pay off your mortgage

All of the main banks allow you to transfer your tracker if you want to trade up, usually at an extra 1%.

In addition, it is much easier to trade up if you have €100k cash, especially if you are in negative equity

2) The lenders might do a deal at some stage to encourage early repayment of your mortgage

While all the banks deny that they will do this, their policy may change in the future.

In particular, Danske Bank and Bank of Scotland want out of the market as quickly as possible. They may sell on your mortgage to a vulture fund, who may give you such a discount. Ulster Bank and ptsb may sell off their cheap trackers.

While the correct financial decision is not to overpay your mortgage, it is better to overpay it than to squander it

If you are good with money, it's better to have a €300k tracker mortgage and €100k in a deposit account, than to have a €200k mortgage.

However, if the presence of €100k tempts you to squander the money, then you should pay down the mortgage.

Other reasons you might pay a lump-sum off your tracker

1) You are concerned that the deposit in the bank might not be safe.

2) Ireland might pull out of the euro. There is a risk that if Ireland pulls out of the euro, your deposit might be converted to punts while your mortgage stays in euro.

3) Having a lump sum might reduce your means tested social welfare payments

If you decide not to pay off your tracker, are there alternatives to deposits worth considering?

Whatever alternative you consider, you must have quick access to your money, in case a deal becomes available.

Investing directly in a balanced portfolio of shares is worth considering. However, you have to realise that there is a risk that the value may fall.

You could consider a unit linked fund or ETF, as long as there are no initial charges or exit charges.

It would generally not be a good idea to invest in property as you will not be able to access your cash if you need it.

Last edited: